Understanding the Concept of Leverage in Forex Trading

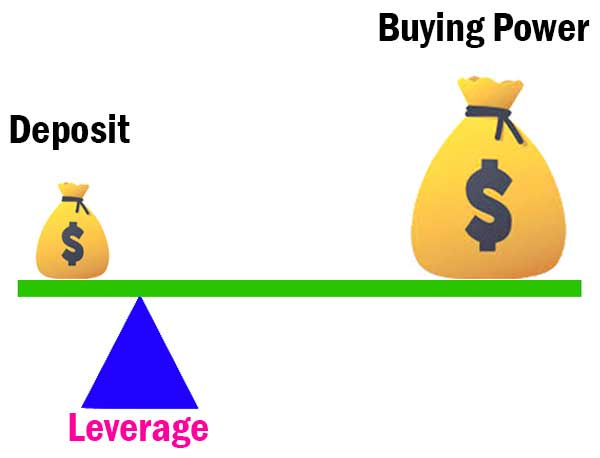

Leverage is a concept borrowed from the world of finance and applied to forex trading. In its simplest form, leverage allows traders to control larger amounts of money with a relatively small initial investment. This is achieved through the use of borrowed capital, typically provided by a broker, allowing the trader to amplify their potential profits.

In forex trading, leverage is expressed as a ratio, such as 100:1, which means that for every $1 of your own money, you can control $100 in the forex market. This allows traders to open positions far larger than their own capital would otherwise permit, hence potentially amplifying their profits. However, it’s important to note that leverage can also amplify losses, making it a double-edged sword.

Leverage operates within the context of margin trading. Margin is the amount of money that a trader must deposit with their broker in order to open a leveraged position. It works as a sort of collateral, ensuring that the broker can cover any losses incurred if the market moves against the trader.

In essence, leverage is like a loan that the forex broker gives the trader, allowing the trader to take on larger positions in the forex market than they could otherwise afford. This can magnify the potential return on investment, but it also increases the risk of substantial losses.

Overall, while the concept of leverage can seem quite complex, understanding it is crucial for anyone who wants to engage in forex trading. It is therefore important for traders to fully understand how leverage works, and the associated risks, before they begin trading.

Pros of Using Leverage in Forex Trading: Expanding Profits

Leverage in forex trading can bring several benefits. The most obvious is that it provides the opportunity for larger profits. If a trader correctly predicts the direction of a currency pair’s movement, leverage can help to significantly amplify the return on investment.

Secondly, leverage allows traders to control larger sums of money than they could otherwise. For those with limited capital, this provides an opportunity to participate in larger trades that may offer more significant profit potential.

Thirdly, leverage can allow traders to diversify their portfolio. By using leverage to take positions in a variety of different currency pairs, traders can spread their risk and potentially increase their overall profitability.

Lastly, leverage can also enable traders to take advantage of small price movements. Due to the high degree of liquidity in the forex market, currency pairs often move in small increments. Leverage can allow traders to profit from these small movements, as it magnifies the potential profitability of each trade.

Cons of Using Leverage in Forex Trading: Increased Risks

- Despite its benefits, leverage in forex trading also comes with significant risks. The most apparent risk is the potential for larger losses. If the market moves against a trader’s position, the losses can be substantial due to the magnifying effect of leverage.

- Additionally, the use of leverage comes with the risk of receiving a margin call. A margin call occurs when the value of the trader’s account falls below the broker’s required margin level. If this happens, the broker may close out any open positions to bring the account back to the required level, which can result in significant losses.

- Another potential downside of using leverage is that it can lead to overtrading. Because leverage increases potential profits, it can tempt traders to take on more trades than they might otherwise, potentially leading to poor decision-making and increased risk.

- Finally, the use of leverage can amplify the impact of trading costs. These costs, such as spreads and commission, are typically based on the size of the trade. Therefore, the larger the trade (and the greater the leverage), the higher these costs will be.

How to Utilise Leverage Effectively in Forex Trading

To utilise leverage effectively in forex trading, it’s crucial to have a solid understanding of both the potential benefits and risks. Here are three key steps:

- Educate Yourself: Traders should fully understand the concept of leverage, how it works, and the potential risks before they begin trading.

- Use Risk Management Strategies: This includes setting stop-loss orders to limit potential losses, diversifying your portfolio to spread risk, and never risking more than you can afford to lose.

- Monitor Your Trades: Keep a close eye on your open positions, and be prepared to close them if the market moves against you. Remember, while leverage can magnify profits, it can also magnify losses.

Learning from Real-Life Cases: Leverage in Forex Market

There have been numerous examples throughout history where leverage has played a significant role in the forex market. For instance, during the 1997 Asian financial crisis, many traders used high levels of leverage to bet against the Thai baht. When the currency collapsed, these traders made significant profits.

However, leverage has also led to substantial losses. During the 2008 financial crisis, many traders were using high levels of leverage to take positions in various currency pairs. When the market turned, these positions quickly became unprofitable, leading to significant losses.

These cases highlight the potential for both massive profits and devastating losses when using leverage in forex trading. They serve as a stark reminder of the importance of understanding and managing the risks associated with leverage.

Conclusion: Balancing the Risks and Rewards of Leverage in Forex Trading

In conclusion, leverage in forex trading is a powerful tool that can significantly enhance potential profits. However, it also comes with increased risks and costs, and should be used with caution.

Understanding the concept of leverage, the associated benefits and risks, and how to manage these risks is crucial for any trader. By doing so, traders can leverage more effectively to enhance their profitability while minimising their potential losses.

Ultimately, the key to successfully using leverage in forex trading lies in balancing the potential rewards against the inherent risks, and always trading within your means.

| Pros | Cons | |

|---|---|---|

| Leverage in Forex Trading | Amplifies potential profits, allows for control of larger sums, enables portfolio diversification, allows profiting from small price movements | Amplifies potential losses, risk of margin calls, can lead to overtrading, increases impact of trading costs |