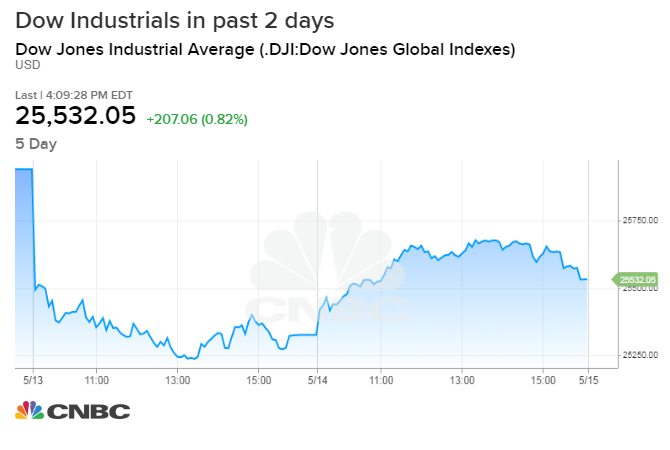

Stocks rose on Tuesday, regaining some of the sharp losses from the previous session, as investors weighed the impact of the escalating trade war between the United States and China.

The Dow Jones Industrial Average rose 207.06 points to 25,532.05, boosted by gains in Visa and Boeing shares. The 30-stock index also posted its best day since April 12. The S&P 500 advanced 0.8% to 2,834.41 as tech shares outperformed. The Nasdaq Composite climbed 1.1% to end the day at 7,734.49.

“That being said, we are going through something that we’ve never gone through before,” Miller said. “This China trade agreement issue is changing investing into something more like speculating because no one knows what direction this thing can go.”

Boeing climbed 1.7% while Apple rose 1.6%. Caterpillar shares gained 1.7%. Bank shares also rose broadly. Citigroup and Bank of America rose more than 1% each while J.P. Morgan Chase gained 0.8%.

Microsoft shares rose 1.1% to boost the tech sector. Cisco Systems also gained 1.4% after an analyst at Bank of America touted it as the tech stock to buy amid rising U.S.-China trade fears. Coca-Cola shares rose 1.3% after Morgan Stanley upgraded it to overweight from equal weight. The bank named the soda maker its “top mega-cap staples pick. ”

Greg Luken, CEO of Luken Investment Analytics, thinks this is a “dead-cat bounce,” or a temporary recovery, however. “I think this is going to last for a while,” he said. “This is not something that’s going to be resolved tomorrow and anybody who says they know exactly how this will play out is spinning a yarn.”

“Only history will tell us if this is good or bad,” Luken added.

Major U.S. indexes tumbled Monday after news that China plans to raise tariffs on $60 billion worth of U.S. imports, beginning on June 1. The list of targeted goods ranges from TV cameras to tequila, and includes a range of agricultural products. Beijing’s move comes after Washington announced last week it would increase tariffs from 10% to 25% on a bulk of Chinese imports.

On Monday, the Dow and S&P 500 fell 617 points and 2.4%, respectively, their worst performances since early January. The Nasdaq dropped 3.4%, its biggest one-day loss of 2019.

In a note to clients Monday, Citi said its China economists are “cautiously optimistic that a trade deal can eventually be signed.” But it added that the “window to avoid further escalations in US/China tensions is closing fast.”

“Ongoing trade flare-ups may continue to swing the stocks in the near-term, but we think the market may have priced a lot of this in,” Citi said.

Trump also tweeted on Tuesday the U.S. is in a “much better position now than any deal we could have made,” noting that “billions of dollars” are returning to the U.S.

Reference:https://www.cnbc.com/2019/05/13/us-stocks-react-to-china-trump-trade-tensions.html